Various alternative internet service providers, or altnets, operate in the UK market.

These compete with Openreach and Virgin Media O2, which currently dominate this market. The hoped-for effect is to democratise the market, rendering connectivity more affordable to the masses and eradicating the digital divide.

This process is fraught with challenges, rendering the altnets’ sustainability potentially elusive

The Overbuild Risk

Altnets build their physical networks to reach potential clients in specific territories. Unfortunately, areas targeted by competing altnets overlap significantly. In some cases, multiple altnets have installed fibre-ready networks in the same neighbourhood, thus targeting the same customers and duplicating this network repeatedly. While this simplifies network ownership, it increases the cost of fibre supply in areas where a single, shared network would suffice, and effectively decrease costs.

Network installation costs are sunk and cannot quickly be recuperated if the company enters financial administration. This exacerbates the financial burden on role players.

The Customer Conversion Challenge

To be profitable, altnets must convert a considerable portion of potential customers in an area to their networks. Customers are slow to convert to new networks, thus hampering the potential profitability in an area. New customer conversion adds immediate costs to the transaction since the customer must also change to a different physical network.

The Profitability Challenge

The market for smaller altnets is fiercely competitive and crowded. The high cost of network installation renders immediate profitability virtually impossible. This difficulty is exacerbated by the increased scarcity of essential materials, such as fibre optic cables, occasioned by the Ukraine war. Further compounding the financial difficulty is inflation, which can partly be recouped through increased pricing. However, increased pricing is often problematic, due to the market’s competitive nature.

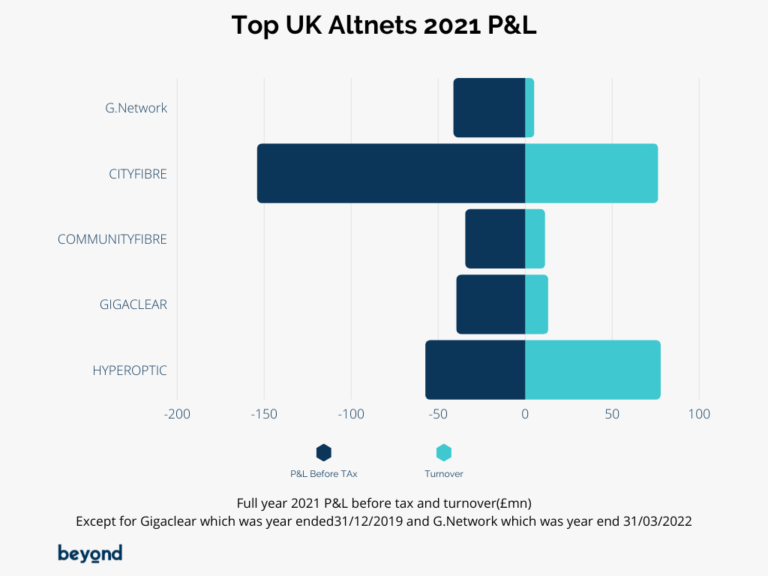

Below is an overview of the financial position of a few prominent altnets, showing all showing financial losses

This information does not foster investor confidence, decreasing the likelihood of securing necessary funding for growth and expansion. Lack of funding further decreases the prospects of profitability.

Government Intervention

The UK government rolled out an initiative called Gigabit roll-out, aimed at providing underserved households with connectivity by the end of 2025. The ambitious aim of providing an additional 15 million homes with gigabit-capable broadband paved the way for the rise of altnets, initially boosting the local telecoms industry.

However, the financial plight of these new altnets is a cause for concern. Further government intervention in the form of funding and regulations may offer a lifeline to floundering altnets, but this may not be sufficient. From a commercial perspective, government intervention would keep the struggling industry afloat artificially. When these protective regulations expire, the dire financial position would likely return, boding ill for smaller network providers. Many are of the opinion that the natural process of business should be allowed to run its course, allowing role players to either leave the market, or settle into sustainable positions.

A View to the Future

Altnets in the UK, in their current form, are not sustainable. Fortunately, there are ways to improve this discouraging situation.

For altnets to survive, mergers and acquisitions seem inevitable. This process would consolidate their networks and other resources, decreasing the risk of overbuilding and potentially increasing customer conversion. In time, this may result in a single altnet dominating the market in direct competition with Openreach and Virgin Mobile O2. There is also the possibility for smaller, struggling altnets to be absorbed into Openreach and Virgin Mobile O2.

Merging altnets in areas where various networks are already installed, would be a fairly simple process. Existing clients would remain on the same physical network, and their usage is paid in arears. This arrangement minimizes the financial obligation to existing clients, minimizing the merger costs. These factors make potential mergers more appealing.

This consolidation may negate democratisation of the market to some extent, but competition between current role players remains fierce. Competition for market share will act to drive prices down, inherently rendering connectivity more affordable for all users in a fair and open market.

To further understand the sustainability and financial plight of altnets, contact us. Beyond’s experienced team understands industry risks and will guide your organisation through uncertain financial climates towards sustainable success.

Beyond insights

Find relevant research, thought pieces and client stories